MegaTonAugust 27, 2024

What Is Polymarket Decentralized Prediction Market, and How Does It Work?

Introduction

Crypto has taken the somewhat negative connotation of the “world’s biggest casino,” with traders betting on anything and everything possible, through the rising trend of meme coins or other vehicles of speculation. As such, it is no surprise that a marketplace designed to facilitate predictions on the outcomes of real-world events would find its product market fit in the crypto arena.

However, prediction markets offer something of value. As Vitalik Buterin, co-founder of Ethereum, covered this topic in a blog post, writing that prediction markets offer the possibility of allowing the “public to make bets about future events, and using the odds at which these bets are made as a credibly neutral source of predicted probabilities of these events.”

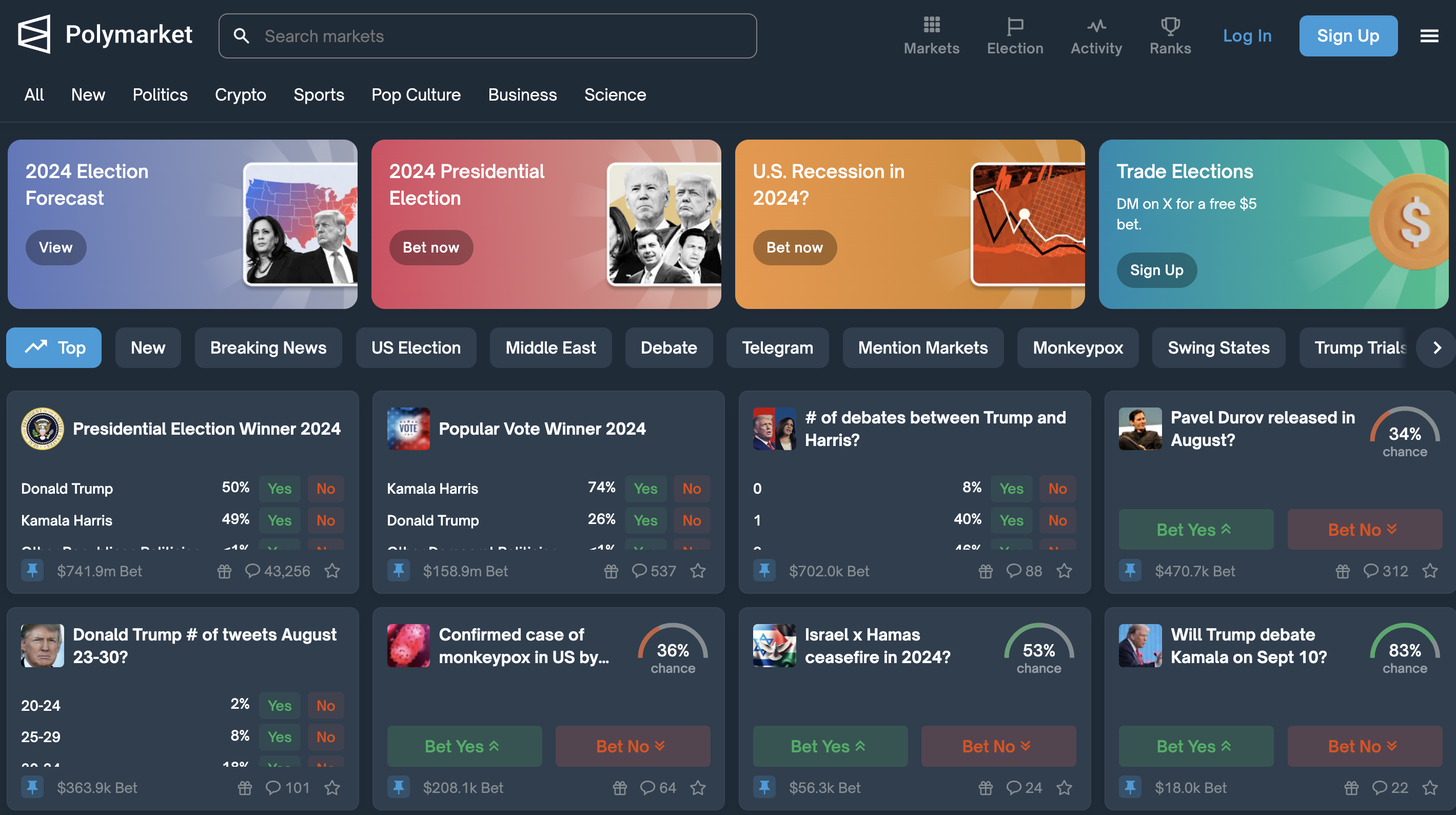

While many prediction market platforms have emerged to seize a share of this lucrative market, none have garnered the market share and mindshare that Polymarket holds today as a leading predictions market in crypto, especially as the US Presidential election races heats up.

What Is Polymarket?

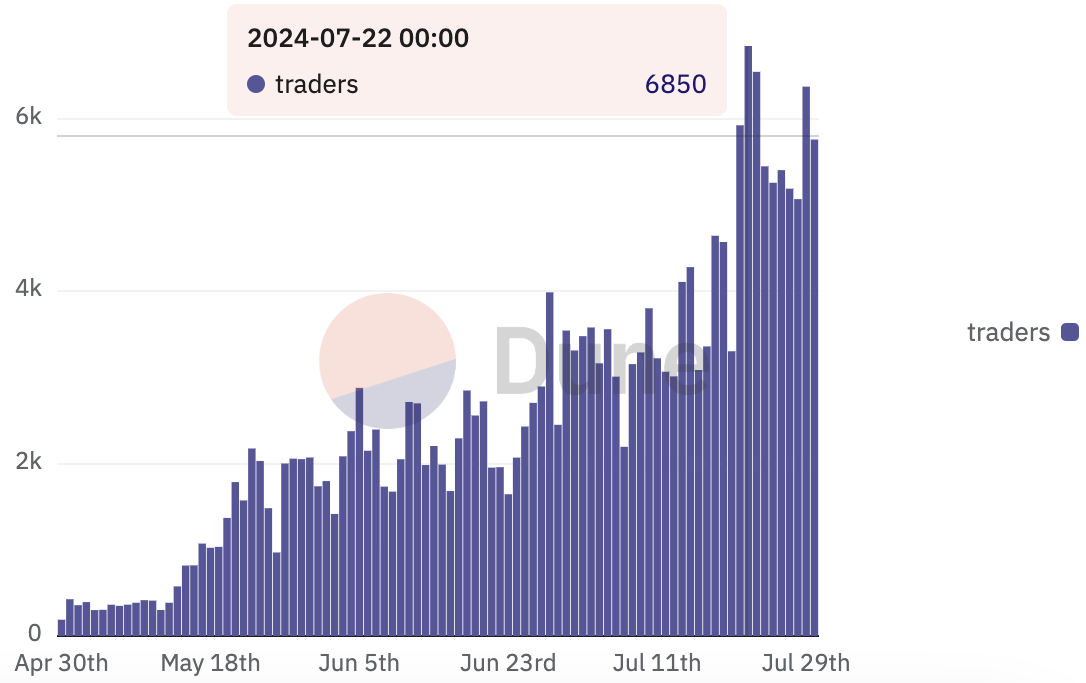

Polymarket is a decentralized prediction market platform on Polygon that allows you to bet on the outcome of various real-world events. This platform is gaining relevance in the crypto landscape due to its unique approach to market predictions and the integration of stablecoins like USDC for betting, which ensures liquidity and stability in transactions. In June 2024, Polymarket hit a high of nearly 30,000 monthly active users.

How Does Polymarket Decentralized Prediction Market Work?

Polymarket works as a decentralized Web3 application, allowing you to place bets on the platform by linking your non-custodial web3 wallets without KYC procedures. In the future, it has plans to incorporate DAO elements for user governance. By eliminating traditional financial intermediaries and KYC processes, Polymarket enhances user privacy and accessibility, embodying DeFi and Web3 principles.

Polymarket leverages blockchain technology to offer a transparent and secure prediction market platform. Whether you’re betting on political events, entertainment, or economic indicators, Polymarket ensures an efficient market experience. It operates primarily on Polygon, a Layer-2 solution, to enhance scalability and reduce transaction costs. This integration allows Polymarket to handle high transaction volumes efficiently without overloading the Ethereum network.

- Smart Contracts: Polymarket uses smart contracts to manage and execute transactions automatically. These smart contracts ensure that all trades and market resolutions are transparent and immutable. When you place a bet or buy shares, the smart contract records the transaction on the blockchain, guaranteeing that the process is secure and tamper-proof.

- Security Measures: Polymarket takes security seriously. Your funds remain in your control through self-custodial wallets, meaning you hold the private keys. This non-custodial approach ensures that Polymarket never has direct access to your funds. Additionally, the platform uses robust encryption and authentication methods to protect user data and transactions. These measures make Polymarket a secure platform for participating in prediction markets.

How Does Polymarket Make Money?

Polymarket generates revenue primarily through its transaction fees paid in USDC. Each time you place a bet or trade shares on the platform, a small fee is applied. This fee is generally minimal and is used to incentivize liquidity providers, who ensure there is enough liquidity in the markets for efficient trading. Additionally, Polymarket benefits from the volume of trades, as higher trading volumes lead to more transaction fees being collected.

Transaction fees play a crucial role in Polymarket’s revenue model. These fees are paid directly to liquidity providers, who facilitate smooth transactions and reduce price slippage. Unlike traditional betting platforms, Polymarket does not charge additional market fees, making it a cost-effective option for users. This structure not only helps maintain liquidity but also encourages more active participation by users.

Conclusion

Polymarket has emerged this year as one of the biggest consumer applications in the crypto space, especially with the world’s attention centered around the 2024 US Presidential Elections.

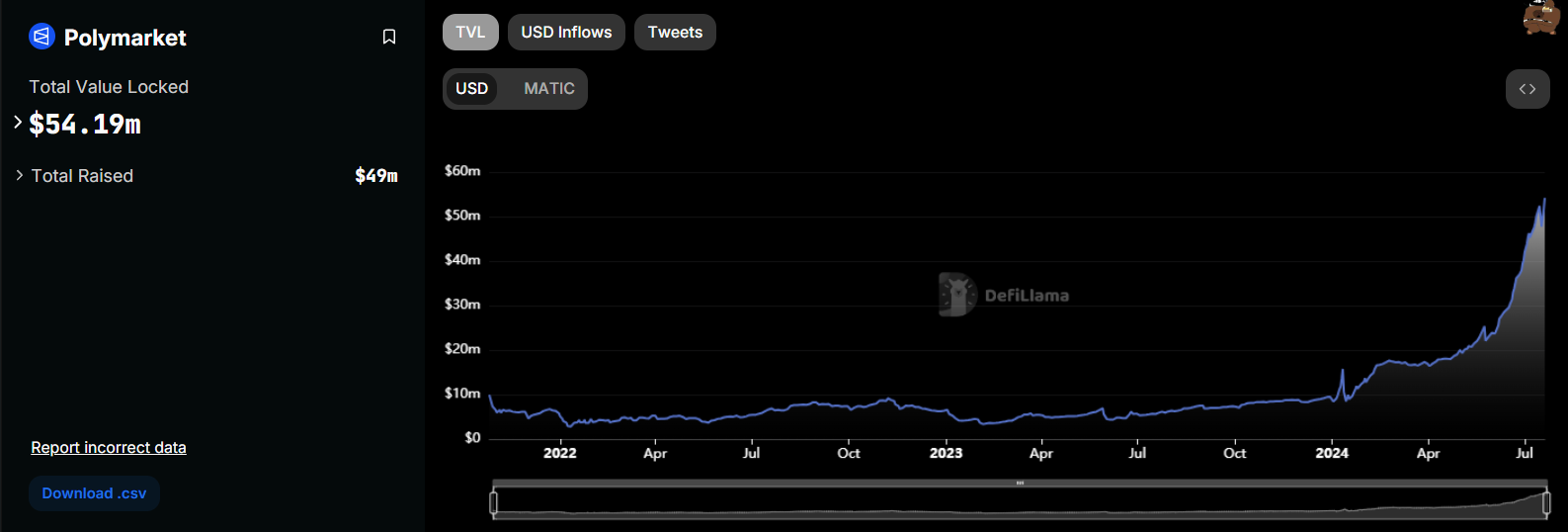

With all eyes on Polymarket, the platform has seen its total value locked (TVL) surge more than 450% since the beginning of the year to $54M, with many expecting the trend to continue as the Presidential race heats up over the next few months, possibly onboarding even more users on to crypto.

Leave a Reply